Where Does Your Organization Fall on the Innovation Compass?

ACCA research finds public finance should look to become even more innovative

ACCA recently surveyed our 4,436 finance professional members across the world, 826 of whom work in public services and not-for-profit finance functions. The results from our survey suggest that public sector finance professionals are just as invested in innovation as their private-sector counterparts. 91% of public sector respondents reported some kind of innovation occurring in their organizations.

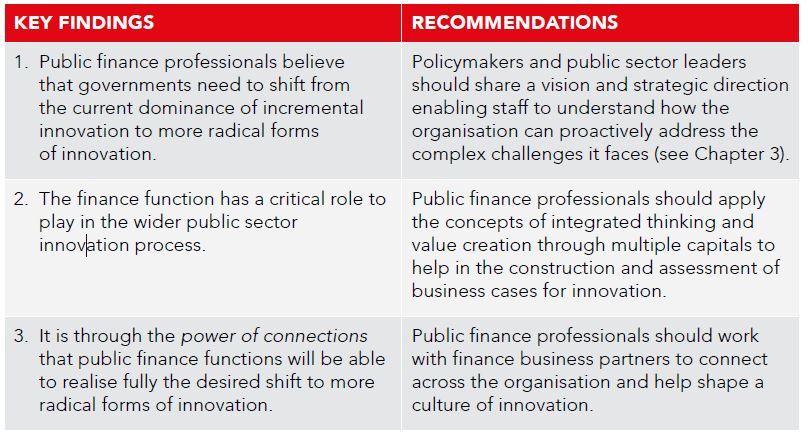

Crucially, the research also found that public finance professionals believe that governments need to shift from incremental changes to more radical forms of innovation.

The innovation compass

Using our tool, the innovation compass, we asked respondents how innovative their organization is. You can use the compass in thinking about your organization as well.

The innovation compass was created to: understand the different types of innovation currently being used; set out a method for categorizing case studies; and provide ways of thinking about how innovation needs to change to meet our current challenges.

Together, the two variables of radical/incremental and directed/undirected comprise its directions.

- Radical – or even transformative – innovation is the change that fundamentally reorganizes how value is created in an organization.

- Incremental – is the combined result of comparatively minor changes to existing systems in the pursuit of improved value, which makes up the majority of innovation today

- Directed – ‘Top-down’, or led by an organization’s management

- Undirected – ‘Bottom-up’ or grassroots level change.

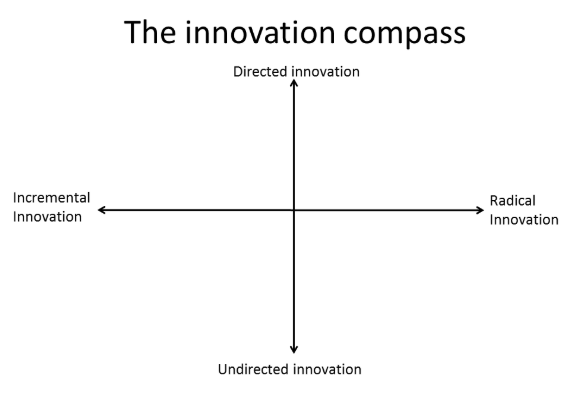

Using the innovation compass, we found that the majority of respondents (67%) believed that the current form of innovation in their organization was incremental.

As you can see, most respondents indicated that currently, they feel the innovation within their organization is incremental and directed.

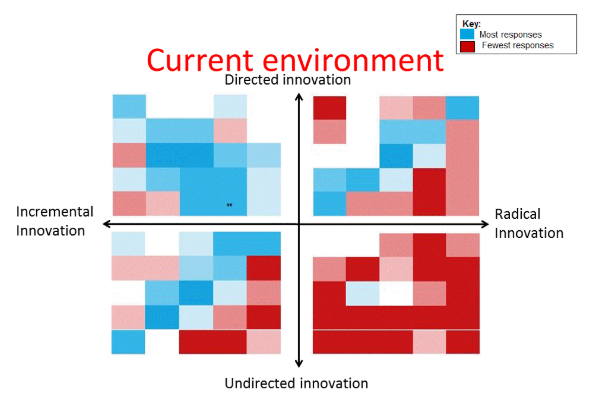

In contrast to the current environment, most responses favour radical and direct innovation for the future.

Preferred future for public finance innovation

There is no denying that there are considerable challenges facing the public sector. Many of you will recognize the twin issues of budget reductions and talent shortages, which can partially indicate what is driving reactive innovation. However, citizens’ expectations, falling public trust, and technological disruption are continuing to alter the environment where governments are already struggling to offer quality public services.

Respondents to the global member survey were asked: in order to respond appropriately to the challenges facing the public sector, what kind of innovation should your organization be undertaking? A clear message arose in response: in order to meet the complex challenges facing the public sector, 79% of public finance professionals believe that governments need to move to more direct forms of radical innovation.

Innovation and the public finance professional

Identifying problems, generating ideas and developing proposals are all part of a collaborative, cross-functional process for creating new innovations that meet the objectives of a public organization. The finance function is central throughout all of this as the group that has the capacity to work across a variety of organizational functions.

In the development of business cases, the finance function may act as the ‘gatekeeper’, often assessing which cases should be adopted or referred to senior management. The budgeting process is led by public sector finance professionals, who can and will need to align specific innovative pilots and initiatives with the organization’s broader objectives and purpose. The finance function tends to also monitor projects, like the initiatives just described, as they are underway. Once that cycle is complete, organizations will be required to report on the outcome of their work through visible means like annual reports and accounts. Public audit crucially identifies issues with existing government initiatives and diffuses the lessons learned.

Connections

For those already undertaking radical innovations in their organizations, collaboration was identified as an important factor. Almost half (45%) of public sector respondents ranked ‘collaborative teams and strong team working’ in their top three factors for supporting innovation in the organization, and they were more likely to look outside their organization for assistance in the development and implementation of new initiatives, as well as work with other groups.

This is understandable for a number of reasons, including that completing the journey to more radical forms of innovation can require input from a broader set of stakeholders. Equally significant is that the majority of financial professionals who took part in our research said they were already working jointly with other teams to achieve innovation in the public sector.

Conclusions

Where would you mark your organization in terms of current innovation? And in terms of where you’d like it to be? Public sector finance officials are uniquely placed to help guide their organizations to more radical forms of innovation thanks to their ability to work across a variety of organizational functions.

Download the full report, “Innovation in public finance” here and be sure to follow ACCA and ACCA Canada on Twitter!

Alex Metcalfe is the head of public sector policy in the Professional Insights team at the Association of Chartered Certified Accountants (ACCA). He leads on developing thought leadership for the public sector and represents ACCA at senior global member forums. Alex Metcalfe is the head of public sector policy in the Professional Insights team at the Association of Chartered Certified Accountants (ACCA). He leads on developing thought leadership for the public sector and represents ACCA at senior global member forums.

Alex has previous experience in the UK and Canadian Civil Service, including working as a Senior Economist – specialising in tax policy – at the Ontario Ministry of Finance in Canada. He has frequently given evidence to UK committees and ministerial roundtables, and was a member of the Home Office Employers’ Representative Group on EU Exit. His published research includes work on the labour and skills needs of small firms after Brexit, as well as economic analysis on the cumulative cost of government policy on small firms. He studied at Oxford, Cambridge and Queen’s universities. |